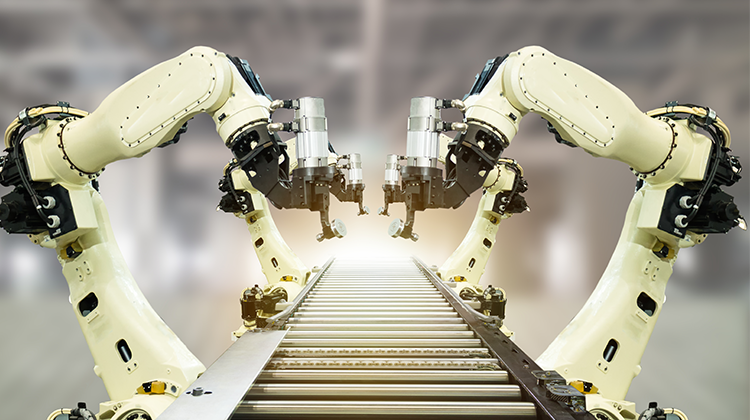

We lease new and used equipment for almost any industry.

If you’re a business that may have limited capital or needs new equipment frequently to stay competitive, exploring your leasing options may be more beneficial. Read more.

When it comes to acquiring new equipment, businesses have two options ─ either securing a loan to purchase the equipment or leasing it. Read more.

Read how a small town in Iowa used equipment leasing to fund a fire station structure without issuing a bond. Read more.

Yes, you can lease both new and used equipment.

In many cases, yes. If the equipment you lease qualifies for the Section 179 tax deduction, you can deduct the monthly payments from your taxable income. Not all types of equipment are eligible, and there are certain IRS requirements that need to be followed. So, make sure to consult with your tax professional.

Lincoln Savings Bank (LSB) is a Full Service Bank and Member of the Federal Deposit Insurance Corporation. Since our founding in 1902, Lincoln Savings Bank has been serving the banking needs of Iowans.

Member FDIC

Leases and all related servicing are provided through partnerships with other lending institutions.

[fa icon="phone"]

[fa icon="envelope"] leasing@mylsb.com

[fa icon="home"] 508 Main Street, Reinbeck IA